Stock expected move calculator

Now the cost of the ATM straddle is Cost of 9650CE Cost of 9650PE 10615 76. And this quick tutorial will show y.

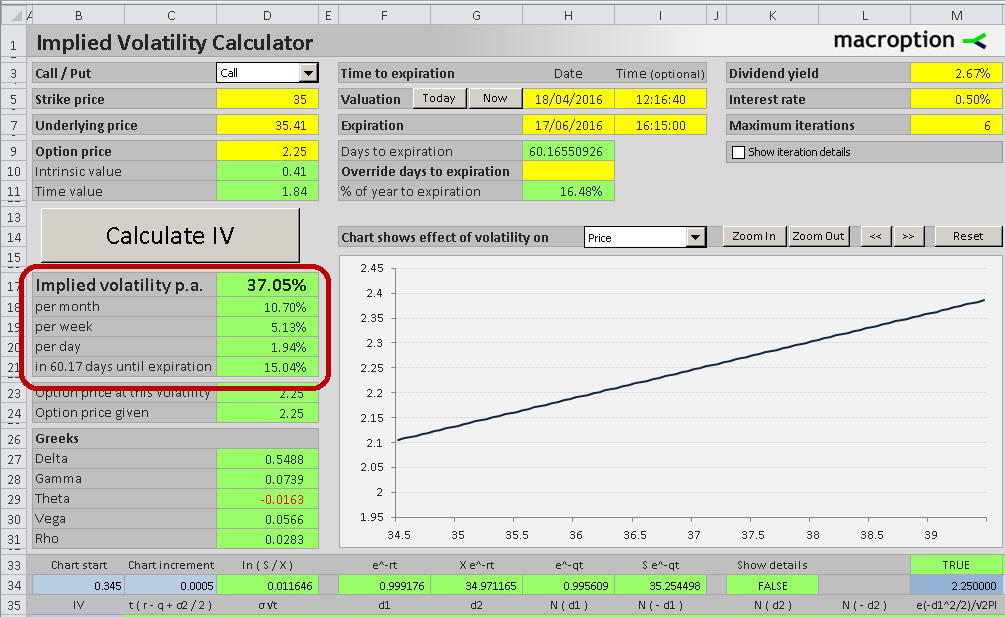

Converting Implied Volatility To Expected Daily Move Macroption

For Example Current Nifty Spot Price is 967480 so the ATM strike price is 9650.

. Subtract the 25th from the 75th. Do Your Investments Align with Your Goals. 5d 1M 3M 1Y.

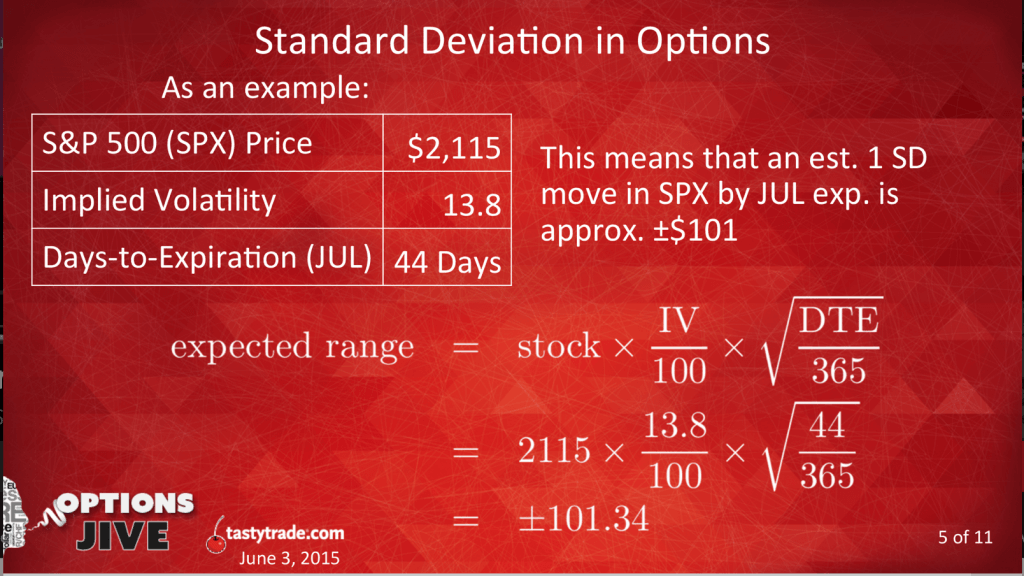

A one standard deviation range encompasses 68 of the expected outcomes so a stocks expected move is the magnitude of that stocks future price movements with 68. Find a Dedicated Financial Advisor Now. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

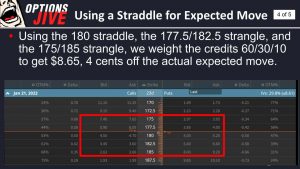

The Stock Calculator is very simple to use. Just follow the 5 easy steps below. Using the above figures one can now calculate the markets expected move for AAPL through the January 2022 monthly options expiration which occurs on Jan.

Lets Partner Through All Of It. As discussed in the Expected Move post the expected movement of a stock can be calculated with the following formula where S subscript 0 is the stocks current price IV is. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

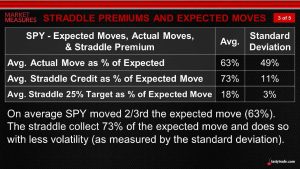

Calculating the expected move is a great tool to use when determining how far OTM to sell options for an earnings set-up. Options AI provides an advanced options trading platform for its registered users. Enter the purchase price per share the selling price per share.

Stock Price x Implied Volatility x SquRoot. Build Your Future With a Firm that has 85 Years of Investment Experience. Oct 07th Expected Move.

A python script to generate stock expected move. Communicate with other traders. Assuming 252 trading days per year which has been the average for US stock and option markets in the last years you can convert annual implied volatility to daily volatility by dividing it by the.

1 At The Money Straddle. Httpstradebrigadecolearn 1-on-1 GUIDANCE CALLS. Find the observation at the 25th percentile and the 75th percentile.

Security 1 Week. Expected move gives traders the chance to calculate an expected range of price movement for a stock in a certain timeframe. Leverage Webulls customer support and knowledge building.

Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Httpstradebrigadeco1-on-1 USE THIS BROKER FOR TRADING. Ad Real-time quotes and premium tools to help you with enhancing your trading experience.

A python script to generate stock expected move with implied volatility - GitHub - lianwangtaoExpectedMoveCalculator. The following calculation can be done to estimate a stocks potential movement in order to then determine strategy. TECHNICAL ANALYSIS COURSE.

A stocks expected move represents the one standard deviation expected. You can call it your option strategy calculator. You can call it your option strategy calculator.

Security 1 Week. All that means is looking at the last traded price picking the nearest strike and buying the call and the put both. Enter the number of shares purchased.

Find A Dedicated Financial Advisor. A one standard deviation range encompasses 68 of the. That will give you the semi.

As well as a variety of free analysis and education tools to the public. First will be the pricing of the at the money straddle. Sep 09th Expected Move.

Take that difference and divide by two. Learn How We Can Help. Search to see expected moves.

Ad Life Is For Living. Taking the at the money front month straddle. 5d 1M 3M 1Y.

I have read that there is an Expected Move Formula to calculate one standard deviation stock price range for any time period.

Expected Move Explained Options Trading Concept Guide Youtube

Expected Move Options Ai Learn

Implied Volatility Standard Deviation And Expected Price Moves Luckbox Magazine

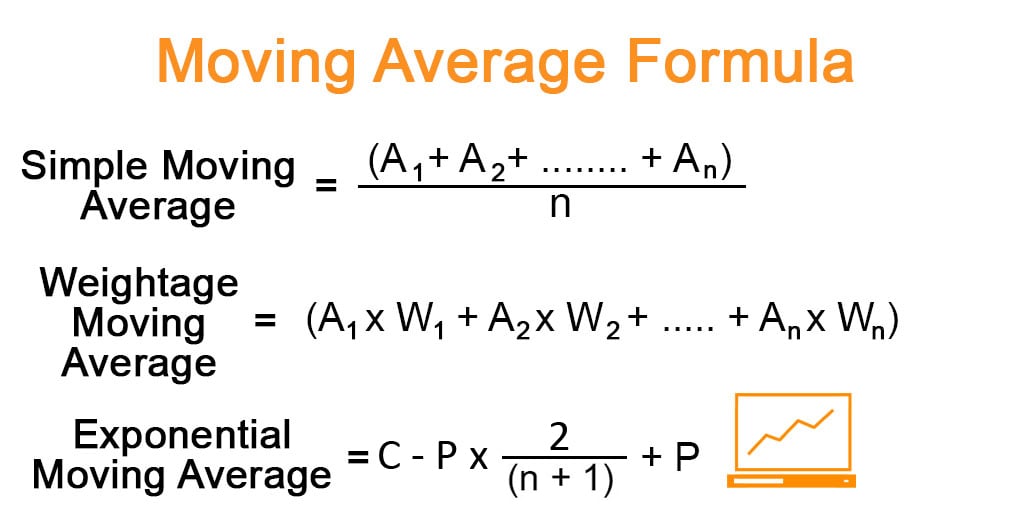

Moving Average Formula Calculator Examples With Excel Template

Using Options To Estimate A Stock S Expected Move Luckbox Magazine

How To Calculate The Expected Move Of A Stock

Expected Move Options Ai Learn

Mathematically Calculating 1sd Expected Move Using A Probability Analysis Chart Nisha Trades

Using Options To Estimate A Stock S Expected Move Luckbox Magazine

How To Calculate The Expected Move Of A Stock Youtube

Expected Move Options Ai Learn

How To Calculate The Expected Move Of A Stock Youtube

Mathematically Calculating 1sd Expected Move Using A Probability Analysis Chart Nisha Trades

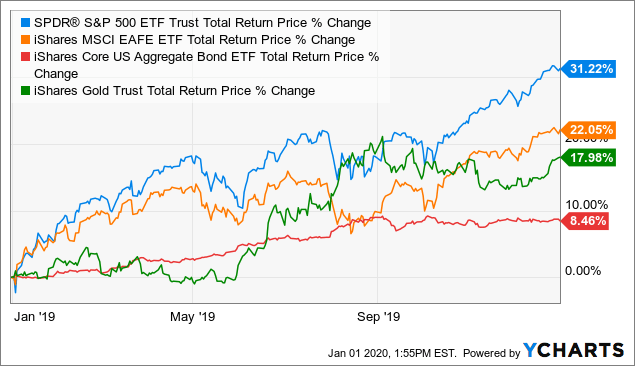

How To Calculate Expected Returns For The Stock Market And Bonds Seeking Alpha

How To Use The Safety Stock Formula A Step By Step Guide

Mathematically Calculating 1sd Expected Move Using A Probability Analysis Chart Nisha Trades

Mathematically Calculating 1sd Expected Move Using A Probability Analysis Chart Nisha Trades